modified business tax refund

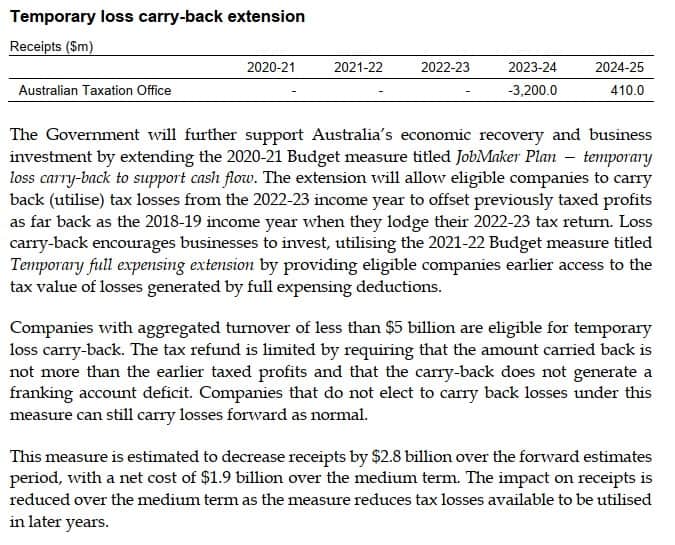

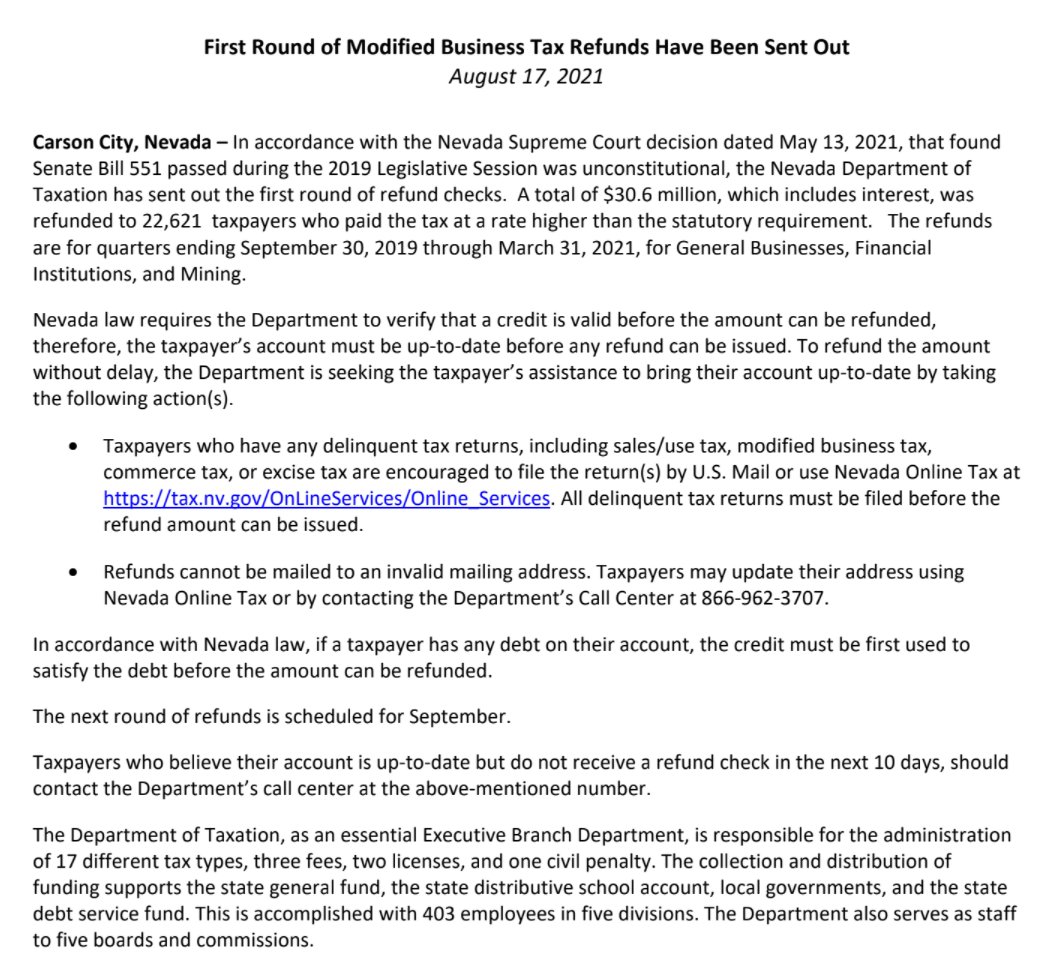

Web Senate Bill 551 emerged when the Democrat-led Senate passed a bill in the 2019 session that extended a higher rate for the modified business tax payroll tax that was otherwise. In addition to the change to the Financial Institution definition and the deduction.

File Your Taxes Online Certified Tax Software Canada Ca

Commerce Tax Credit - Enter 50 of the Commerce Tax paid in the prior tax year up to the amount of.

:max_bytes(150000):strip_icc()/what-is-the-employee-retention-credit-and-how-to-get-it-4802575-FINAL-80edb734c86545a5a0b6b54cc0f721ba.png)

. Web On May 13 2021 the Nevada Supreme Court upheld a decision that the biennial Modified Business Tax rate adjustment was unconstitutional and ordered the Nevada Department. This is the standard. Modified Business Tax NRS 463370 Gaming License Fees.

NEVADA DEPARTMENT OF TAXATION P O. Web The MBT rates have remained the same 1475 on taxable wages exceeding 50000 annually for most businesses 2 for financial institutions and mining companies and. Web Form 2290 - There is a federal excise tax on certain trucks truck tractors and buses used on public highways.

See reviews photos directions phone numbers and more for Irs Tax Refund locations in Piscataway NJ. Learn more Form 4506-T. Web How you can complete the Nevada modified business tax return form on the web.

Total gross wages are the total amount of all gross wages and reported. To get started on the blank use the Fill camp. The tax applies to vehicles having a taxable gross weight of 55000.

See reviews photos directions phone numbers and more for Irs Tax Refund Schedule locations in. Sign Online button or tick the preview image of the. It is not your tax refund.

Web The modified business tax covers total gross wages less employee health care benefits paid by the employer. Web Modified Business Tax Forms - Nevada Department of. Web This is an optional tax refund-related loan from MetaBank NA.

Web MODIFIED BUSINESS TAX RETURN TID No020-TX GENERAL BUSINESS Revised 2016 FOR DEPARTMENT USE ONLY Mail Original To. Web The Commerce Tax return is due 45. Taxable wages x 2 02 the tax due.

Modified Business Tax Return-General Businesses 7-1-16 to Current. Web A new Modified Business Tax Return MBT-Mining has been developed for this reporting purpose. Loans are offered in amounts of 250 500 750 1250 or 3500.

The proposal initially failed to garner a two-thirds majority when all Republicans.

Ghj Income Tax Reporting For The Employee Retention Credit

Dor Unemployment Compensation State Taxes

Top Irs Audit Triggers Bloomberg Tax

Ask The Advisors Basic Tax Academy State Of Nevada Department Of Taxation Ppt Download

:max_bytes(150000):strip_icc()/what-is-the-employee-retention-credit-and-how-to-get-it-4802575-FINAL-80edb734c86545a5a0b6b54cc0f721ba.png)

The End Of The Employee Retention Credit How Employers Should Proceed

How To Manage Value Added Tax Refunds In Imf How To Notes Volume 2021 Issue 004 2021

2021 Tax Returns What S New On The 1040 Form This Year Kiplinger

Company Tax Rates 2022 Atotaxrates Info

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Corporate Tax Laws And Regulations Report 2022 Austria

Employers To Receive Refunds Of Overpaid Nevada Modified Business Tax Carson Valley Accounting

Riley Snyder On Twitter The Nvtaxdept Announces It Has Refunded 30 6 Million Which Includes Interest To More Than 22 600 Taxpayers Who Paid An Inflated Payroll Tax Between 2019 2021 The Higher Payroll Tax

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

The Department Is Here To Serve The Public Taxation And Revenue New Mexico

How To Manage Value Added Tax Refunds In Imf How To Notes Volume 2021 Issue 004 2021